Founder Story:

Alex Reed, President and COO, Yokogawa Fluence Analytics

From a Tulane lab to a global acquisition, the journey of Fluence Analytics

Q: How did Fluence Analytics start?

A: Fluence Analytics was a spin-out, originally called Advanced Polymer Monitoring Technologies, from the physics department in Tulane's School of Science and Engineering. I grew up working in the lab of my father, Prof. Wayne Reed, whose research and patents were the basis for the company. After many years of government funding, he also received significant interest and funding from global chemical and pharmaceutical companies, which continues to this day, including ongoing projects with Moderna and Spark Therapeutics. At this point I became very interested in innovation and technology commercialization because of the mentorship and guidance from Dr. Bill Bottoms, an accomplished Silicon Valley technologist, investor and executive, as well as many other advisors and mentors over the years. After a lot of research and collaboration with industry, Professor Reed, myself, our CTO Mike Drenski and our chairman Dr. Bill Bottoms decided to create the company to license the technologies and commercialize them into products. One thing that was critical was having a founding team with complimentary skillsets. We then proceeded to start operations securing a substantial Joint Development project with our first customer, secure federal grant funding and raise some modest seed capital from our friends and family who believed in us. Many of our early investors were members of the Tulane community. None of it would have been possible without all of the foundational work and innovations from Prof. Reed.

Q: Can you give an example of how a company may use ACOMP technology?

A: Polymers, which include everything from specialty to commodity plastics, rubbers, adhesives, coatings among many other types, are vital to our modern way of life. The production of these building block materials can be fairly complicated. Fundamentally, the way these materials perform in their end-use applications depends heavily on the physical properties of the material; a few examples would be elasticity, adhesion, reflectiveness and tensile strength. Controlling these large scale production plants to produce a consistent product across many different sites all over the world on the most optimal, resource efficient path is actually a very challenging problem. You have changing feedstocks, different workforces, varying equipment and many other ever changing inputs. A significant missing component is the ability to assess the properties, in real-time, of the material being synthesized. Currently, this is done periodically, slowly and off-line. Automatic Continuous Online Monitoring of Polymerization (ACOMP) is a multi-parameter analytical measurement tool combined with proprietary analysis algorithms to produce a unique, real-time data set of these polymer reactions. A customer would use this directly in their production or in their R&D labs to improve their understanding, and ultimately their control, of their processes. Through real-time data, our technologies allow our customers to enhance yield, quality and efficiency in their R&D and manufacturing operations. Additionally, as the polymer industry continues to rapidly evolve in material properties, complexity and range of applications, improved performance and control will be critical. Finally, with the advent of chemical and biological recycling technologies for waste plastics, adapting ACOMP and other technologies to enable the economic scale up of these types of chemistries will be very important in the drive toward circularity.

Q: With Fluence Analytics now part of Yokogawa Electric, how do you envision the company's future growth trajectory?

A: Yokogawa is a global technology leader in the process measurement and control system space. The strategic fit of our technologies within their product portfolio, and their vision of ushering in a future of autonomous industrial operations, is perfect. Like any acquisition, success lies in the post-acquisition meshing of cultures, appropriate resource allocation and building a synchronized global execution strategy. We are still in the relative infancy of the new partnership, but we are expecting some important announcements later this year, which are the result of combining Yokogawa's excellent hardware development expertise with our technologies and application knowledge. If we can continue to leverage each organization's strengths to build up a combined organization, the potential for the products is tremendous. We will be able to offer unique hardware/software solutions to customers all over the world at a scale we couldn't achieve as a small technology startup.

Q: Given your experience both in academia and industry, what advice would you give a Tulane faculty member interested in commercializing their research?

A: Find people with complementary skills, aligned values and a shared vision that you can work with. Successful hard science and technology startups often require the combination of deep technical expertise with an entrepreneur to drive it. Oftentimes, the faculty member interested in commercializing their work will need to partner with someone to build the business i.e. build a team, develop the operations, bring in customers and find funding. Plus having someone in the trenches with you early is critical to surviving the ups and downs of the journey. I would also recommend finding advisors and mentors to guide you. You can learn a lot from other people's experience. Unfortunately, you can't learn everything this way so you will make mistakes and need to learn from them as quickly as possible. Good advisors and mentors can at least prevent you from making fatal ones and help you learn from the ones you do make. Finally, understanding the relationship between your customers, your technology, your technical and commercial milestones and your runway is critical. The easiest way to de-risk these is through significant investment in customer discussions as early in the process as possible. This can help confirm assumptions, market size, and give you important feedback for milestones you will need to achieve to be able to sell into your target customers. Using this information to then build a realistic path to commercialization lends the most credibility. Another major advantage is the ability to de-risk the technology as much as possible while incubating in the university. If you can secure intellectual property and some key validation data early, along with the aforementioned customer feedback, it will be your meal ticket to your next sources of capital to continue to scale.

Q: How did Tulane help you with your journey?

A: Tulane was very supportive along the way. Once we began to work on the idea of a startup around all of the innovative work done by Prof. Reed, the Technology Transfer Office and the administration were extremely helpful. They worked with us as we collaborated with industry through the research center and were instrumental in funding Prof. Reed's patents and licensing the technology. They also introduced us to other support resources in the city like the New Orleans BioInnovation Center and the BioFund (an early investor) and Idea Village, which were all very important for our early development. Through the SSE Advisory Board, we were introduced to a number of alumni that helped make introductions in our fundraising, recruiting and early sales efforts. In fact, one of the introductions to our first institutional venture investor, Energy Innovation Capital, came through a Tulane donor on the SSE Advisory Board, and the EIC Partner who first sat on our Board, W. George Coyle, turned out to also be a Tulane alumnus.

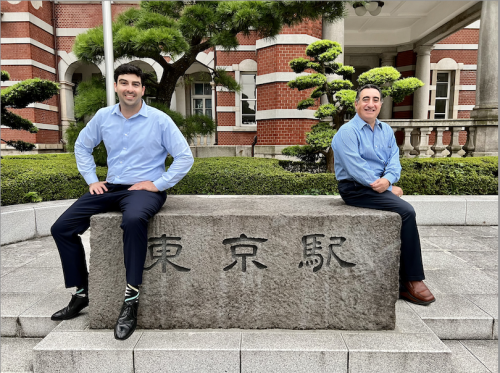

Our entire team had several affiliations with the university. We were alumni (myself, Mike and Bill Bottoms), staff (Mike and I), faculty (Wayne) and even an emeritus member of the Board of Tulane (Bill). Finally, a late, but absolutely critical addition, Jay Manouchehri, turned out to be a Tulane alumnus as well! I was burned out and was actually looking for a CEO replacement when I got connected to Jay through some industry contacts. We ended up having a two and a half hour call that was originally supposed to be thirty minutes. We had hit it off and also found the mutual Tulane connection. After a few months of discussions, Jay agreed to join, but his condition was that we had to do it together as co-CEOs. I didn't actually believe it would work, but I learned a tremendous amount from the combination of our complementary skill sets and from his experience. His strategic ability and his humility are world class. I can say with absolute certainty that without Jay, we would not have achieved the result we did. Through our newfound partnership, he and I navigated COVID, a company move to Houston, a fundraise and the exit to Yokogawa together in two years that felt like a decade.

In the end the foundational work from Prof. Reed, along with the support and connections from the Tulane community, were all instrumental on the journey.